Did you know ?

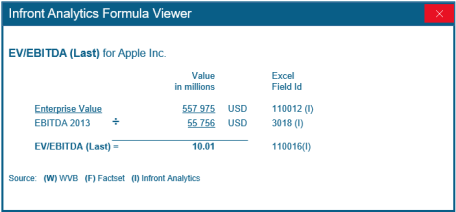

Infront Analytics provides full transparency on calculation formulae for most analytics. Just click the market multiple or financial ratio figure to open the formula viewer.

It is possible to further drill down through the calculation chain clicking underlined figures.

Australia

Australia Factsheet

Factsheet